In age electronic digital financial, we frequently neglect the importance of the standard teller windowpane. The teller windowpane is a crucial a part of consumer banking that allows buyers to complete transactions quickly and efficiently. The teller windowpane ensures that clients acquire substantial-top quality customer satisfaction, along with their economic teller window needs are satisfied quickly. In the following paragraphs, we are going to check out some great benefits of the teller windows as well as its efficiency in banking providers.

Custom made Customer Support:

One of many important great things about the teller home window is that it offers custom made customer care. Customers can connect with a teller encounter-to-face and ask inquiries and clarify their doubts as opposed to relying on chatbot support. Teller microsoft windows assist consumers feel secure knowing another person is handling their financial purchases, instead of experiencing like these are performing the transactions by itself. The teller window can endear buyers towards the financial sector and feel as if they can be a part of a local community.

Speed and Efficiency:

The teller windows is additionally fast and efficient. Teller microsoft windows can be a daily life-saver during hurry hour and holiday seasons when Atm machine lines are a long time. Most banking companies have multiple teller home windows open up throughout the day, permitting much less wait around times and fast transactions. An experienced teller can complete a financial transaction with wonderful pace, ensuring that customers are not holding out in long facial lines. The teller window is simply the smartest thing for buyers that desire a brief fiscal transaction.

Versatility:

As a result of flexibility from the teller home window, it could supply a lot not only put in and withdrawal characteristics. Some tellers are experts in distinct providers like foreign currency exchange, personal loan questions, plus more. This benefit-included support makes certain that buyers have their consumer banking needs satisfied on a far more private and customized stage.

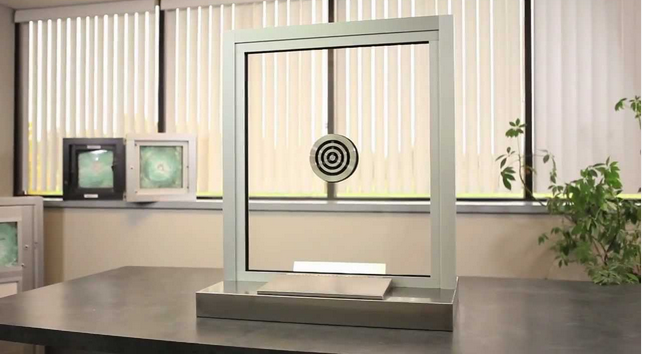

Authentication and Protection:

Protection is essential in financial, and teller house windows present an additional level of protection that clients can depend upon. Banking companies ordinarily have great-top quality safety measures in place and experienced tellers that can swiftly identify fake routines. Teller windows also provide safe methods for clients when they want to pull away or down payment sizeable amounts of money.

Promotes Protecting Routines:

The teller window facilitates the financial savings practice in customers by promoting small price savings banking institutions. Some banking companies have preserving accounts for children that promote preserving behavior, and banking companies make use of the teller windows to teach clients on savings and financing. The teller window not just supplies fiscal suggestions but will also help clients create monetary literacy which will be helpful in the long term.

In short:

The teller home window remains to be just about the most essential elements of business banking. It allows for personalized customer service, speed, productivity, flexibility, authentication, protection, and price savings habits to consumers. Whilst on the internet business banking is rapidly improving, the teller window continues to be crucial for individuals who search for the very best fiscal dealings and customized customer service. The teller home window is not merely a way of performing lender transactions, nevertheless it works as a valued customer practical experience that is essential in today’s financial circumstance.