Metatrader 4 can be a well-liked investing system among investors throughout the world. This straightforward-to-use and powerful platform offers innovative charting tools, signals, and investing features that permit forex traders to get into the worldwide market segments and industry various possessions in the convenience of their property. If you want to learn

Metatrader 4, this extensive information offers you every one of the important details and phase-by-stage recommendations you have to develop into a skillful investor on this platform.

1. Knowing the Metatrader 4 Graphical user interface

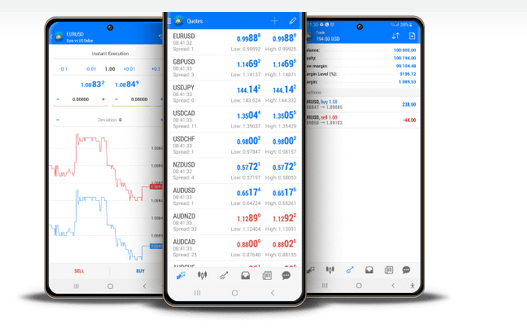

The Metatrader 4 user interface might seem frustrating at first, but it’s very easy to understand once you know its format. The platform’s primary window is split into several segments, including the Marketplace Observe, Navigator, Terminal, and Graph windows.

The Marketplace Observe windows exhibits different market place instruments along with their prices, enabling you to record the resources you’re thinking about. The Navigator windowpane shows your account information, indicators, and expert analysts. The Terminal window is where you can handle your trades, look at your account record, and gain access to the platform’s a variety of capabilities.

The Graph window is the place you can look at the retail price actions of a distinct advantage and assess its trends. The chart windows gives a wide array of changes possibilities that permit you to change the chart’s shades, timeframes, and signs. Perfecting the Metatrader 4 graphical user interface is the first step toward becoming a proficient forex trader about this system.

2. Using Indicators to Analyze Market Developments

Indicators are crucial tools for examining market place developments and creating successful buying and selling selections. The Metatrader 4 platform gives a variety of indicators, including relocating averages, Bollinger bands, MACD, and RSI. These signs supply important ideas in to the market’s tendencies, volatility, and momentum.

To work with indicators, you need to affix these to the chart windowpane of a certain tool. You may customize the indicator’s options, like timeframe, period, and shade. By studying the indicators’ impulses, you could make knowledgeable trading selections and improve your earnings.

3. Putting and Controlling Investments

Positioning and controlling deals in the Metatrader 4 system is straightforward. To open up a buy and sell, you should find the tool you need to buy and sell, enter in the trade’s sizing and path, and set your cease loss and consider revenue levels. You can even use pending orders placed to open investments automatically with a specific cost levels.

Handling deals on the system is additionally straightforward. You may adjust your trade’s end damage, get earnings, and trailing quit ranges at any time. You can also close up your investments manually or set up automatic stop loss and take revenue ranges.

4. Using Skilled Advisors to Automate Your Buying and selling

Skilled Consultants (EAs) are programmed buying and selling algorithms that will help you speed up your forex trading and optimize your income. The Metatrader 4 system delivers a variety of EAs, such as scalping robots, craze-subsequent robots, and hedging robots.

To utilize EAs, you need to attach these people to the chart windowpane of the distinct resource. You can change the EA’s options, like entry and get out of regulations, quit damage and consider income amounts, and danger managing factors. When you switch on the EA, it will automatically open and close investments depending on its algorithm.

5. Growing Your Buying and selling Method

Developing your buying and selling method is vital to transforming into a effective forex trader about the Metatrader 4 program. Your forex trading technique ought to include your forex trading targets, chance administration program, forex trading timeframe, and asset variety criteria.

To formulate your trading approach, you must assess the market’s styles, examine your trading history, and backtest your tactics. The Metatrader 4 system delivers an array of backtesting equipment which allow you to test your trading methods on traditional info.

Bottom line:

Understanding the Metatrader 4 program is important for everyone who wants to trade the worldwide trading markets and maximize their revenue. By comprehending the platform’s interface, making use of indications to assess industry tendencies, placing and dealing with deals, employing skilled experts to improve your buying and selling, and growing your forex trading approach, it is possible to turn into a efficient trader about this system. Using this type of extensive manual, you might have every one of the crucial information and move-by-stage recommendations you have to start your vacation being a effective Metatrader 4 trader.